Excess

Member

In terms of Wall Street condescendingly hating us for manipulating markets, I'd say we all have a little Jordy in us now.This is cringe as fuck and... wasn't he exactly one of them?

In terms of Wall Street condescendingly hating us for manipulating markets, I'd say we all have a little Jordy in us now.This is cringe as fuck and... wasn't he exactly one of them?

it's over guys, nice pump and dump by reddit

I'm retarded, but how would short interest be so high if all the short sellers have already allegedly covered or closed out their short positions? If that were the case would the short interest not be lower?

It just doesn't make sense that all these articles keep coming out bashing retail investors. Reminds me of a crazy butthurt ex-girlfriend who pretends like she doesn't care, but keeps posting stuff on social media about the guy being a dick. If you have no horse in the race and had moved on, WTF are you doing still perpetuating all this BS?

premarket dumping,make it stop!

what kind of endgame we are looking at?

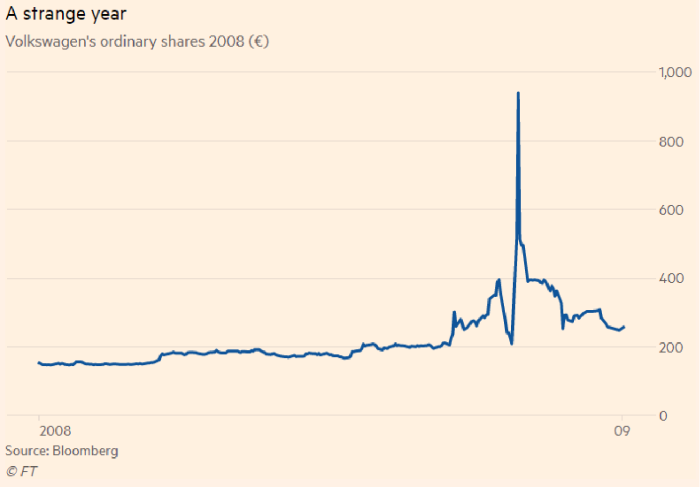

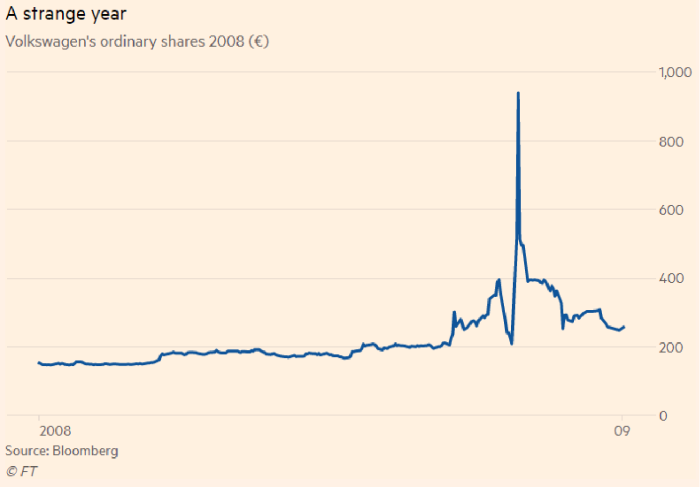

is it even possible to see another 2x, 3x jump? vw did not do that.

seems like a trap to get more retails in at 100-150 before the final dump

I do enjoy that this is one thread on Gaf that brings everyone together.

I think everyone likes a little bit of organised chaos.

and its their own damn fault.All these newer people that bought in at $300+ will have to sell their shares back for a fraction of that. They are getting the authentic Gamestop shopping experience.

Yep...they bought in to all the "it's going to $5000!" hype on WSB when realistically no one knows what could happen and a lot of the "analysis" being done over there is garbage.and its their own damn fault.

Yep...they bought in to all the "it's going to $5000!" hype on WSB when realistically no one knows what could happen and a lot of the "analysis" being done over there is garbage.

On what?Can you elaborate?

It's all going into physical silver.People are selling and I'm interested in seeing how much will flow into bitcoin and ethereum.

See that dip back to almost retail normals? That was 6 days of red.

It’s not a question now if the shorts are still in a shitty situation, they are, but the question now is how they’ll control the damage? As a squeeze ala VW with today’s market caps would really leave a crater.

So why no peak? What’s going on? Most likely, Synthetic longs.

Unless a whale does not force a trigger by applying too much pressure, they hid the inevitable in synthetics, at best they hope to have a long stretch of high, rather than a peak. (And would explain those 800$ calls)

Creator of those synthetic shares has 21 days to deliver. They are not paying interest in the meantime..

/not financial advice, sir, this is a casino

If this is right, or if gme follows this trend, today is the end game now.

gme dead down to normals

On the garbage analysisOn what?

Short squeezes don't operate on magic or hive-mind mentality like regular stocks do.

There is a cut off day for the HF to return their loans. Its a contract. That day is today so i'm told. So the heavy price movements you are seeing now already contemplates the HF buying stocks to return them. They are being squeezed but they also succeeded in lowering the starting point by triggering a panic sell.

Also, I don't know what i'm talking about.

So did the redditors that could have cashed out millions ever cash out or are they on suicide watch?

This past week of ladder attacks could have been shorts trying to hedge their losses

If they know they're about to lose billions they better make as much as the can in the meantime

Its been that way since last week (and even longer). WSB started the fire, but Blackrock, Vanguard, Fidelity, kept the fight going. The "diamond hands" are the HF on the otherside from Melvin and a few others.

There's no volume for anything to be perceived as "dump", from either bulls or bears. There's no reasons to spend millions of dollars on a short attack ladder (it's not free you know, every attack they lose money) if they are out, there's no reasons to spread so much FUD in media if they are out, there's no reason to hire bots if they're out.

There's also this :

This is no longer WSB. See these 800 calls and their insane premium values, all on the same date?

It's a battle of hedge funds. There's Fidelity, Vanguard who are long on GME and now Blackrock joined. There's so much bigger whales in % of the shares than WSB, it's not even comparable. Hell, it might even be Citadel offsetting their eventual losses by buying in the low dips, such a far out call in price knowing full well eventually they have to pull out and the squeeze happens, a calculated insurance on their side. Just a guess.

But one thing for sure, it's not about WSB vs hedge funds, it's HF vs HF. Way too big whales in the ocean for just WSB, at best, they have ~20% of shares. If it was not COVID times, these HFs would probably have made a party, including competitor HFs last week and snort coke off a hooker's ass and talk how they"ll make the other one a bitch and so on.

It's a war within Wall Street, and probably foreseen way before it blew up on Reddit by bullish hedge funds. So this is pretty much my cue to exit soon if price goes back up a bit. If it does not go back up by end of week, there's not much reasons to sell i would say, if i lose money, and i did not put anything i could not part with in it, might aswell see this throught and see how those big HFs are playing the game at the casino, because to get those 800$ calls, someone is confident it'll rocket up.

WSB has gotten so big it is hard to tell what is real and what isn't. There's people showing random data that says the short is 40%. Then there's someone else with a bunch of images that say the short is above 100%. A lot of times you can't even tell where the users are pulling their images and data from. It kind of reminds me of GAF tech threads where you have people throwing around random terms like "cache scrubbers!", "I/O bottleneck!", etc. but it doesn't really feel like a lot of people know what they are talking about outside of throwing around random stuff they saw on Twitter or Youtube.On the garbage analysis

All these newer people that bought in at $300+ will have to sell their shares back for a fraction of that. They are getting the authentic Gamestop shopping experience.

WSB has gotten so big it is hard to tell what is real and what isn't. There's people showing random data that says the short is 40%. Then there's someone else with a bunch of images that say the short is above 100%. A lot of times you can't even tell where the users are pulling their images and data from. It kind of reminds me of GAF tech threads where you have people throwing around random terms like "cache scrubbers!", "I/O bottleneck!", etc. but it doesn't really feel like a lot of people know what they are talking about outside of throwing around random stuff they saw on Twitter or Youtube.

In all this, I still did not understand what purpose does an hedge fund accomplishes.

From a outsider perspective, looks just like high stakes gambling, but I'd like to think there's at least an hypothetical serious function to those.

Any european care to explain to me how can i get on the GME train from europe?

What's the implications of this?

What's the implications of this?

It looks like this automatically happens based on price % decline from previous close.

What's the implications of this?